Table of Contents

- Fannie Mae Issues Servicing Guide Announcement SVC-2024-04 - TENA

- Fannie Mae Upgrades Data Validation Capabilities in Desktop Underwriter ...

- Fannie Mae

- Lenders' Profit Outlook Retreats As Mortgage Rates Tick Up

- What is Fannie Mae & Freddie Mac and How Do They Work? - Jackie Mack

- What You Need To Know about Fannie Mae Foreclosures: www.homepath ...

- Economy Will Tip Into ‘Modest Recession’ in Q1 2023, New Fannie Mae ...

- Fannie Mae Offers Affordability Incentives for Multifamily Borrowers ...

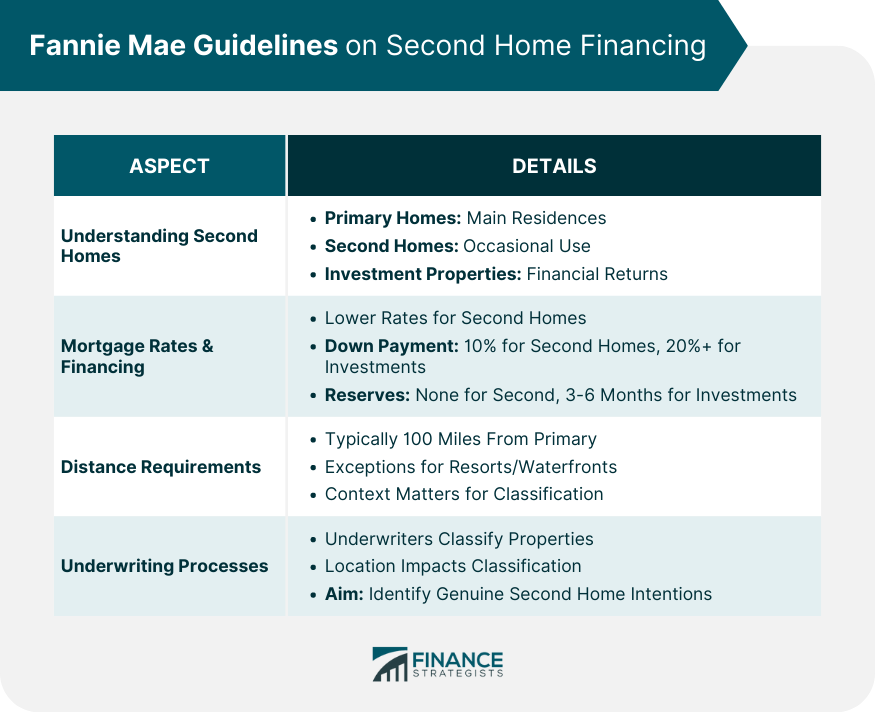

- Fannie Mae Guidelines on Second Home Financing

- Fannie Mae Logo PNG Transparent & SVG Vector - Freebie Supply

Benefits of Single-Family Homes

Advantages of Working with Fannie Mae

/cloudfront-us-east-1.images.arcpublishing.com/dmn/7H33H57C3NHJLBZM7GA4GZO2KU.jpg)

Getting Started with Fannie Mae

If you're interested in purchasing a single-family home with Fannie Mae, here are the steps to get started: 1. Check your credit score: Your credit score plays a significant role in determining your eligibility for a mortgage. Check your credit report and work on improving your score if necessary. 2. Get pre-approved: Fannie Mae offers pre-approval, which gives you an estimate of how much you can borrow and helps you narrow down your home search. 3. Find a home: Work with a real estate agent to find a single-family home that meets your needs and budget. 4. Apply for a mortgage: Once you've found a home, apply for a mortgage through Fannie Mae's online platform or by working with a mortgage broker. In conclusion, single-family homes offer a unique set of benefits that make them an attractive option for many homebuyers. With Fannie Mae, you can take advantage of competitive interest rates, flexible loan options, and a streamlined process to make your dream of homeownership a reality. By following the steps outlined above, you can get started on your journey to owning a single-family home with Fannie Mae. Whether you're a first-time homebuyer or a seasoned homeowner, Fannie Mae is here to help you every step of the way.Keyword density: Single-family homes (1.2%), Fannie Mae (1.5%), mortgage financing (0.8%), homeownership (0.5%)

Note: The keyword density is calculated based on the total word count of the article. The recommended keyword density is between 0.5% to 1.5%.